Just like you’d go to an expert to authenticate a collectible rookie card or a pokemon collectible set, you do not any of that because the blockchain keeps a record of it all. Projects like Bored Ape Yacht Club, Animatas, Pudgy Penguins, etc have skyrocketed in recent days, and some of these computer-generated unique avatars are selling for hundreds of ether tokens (one ETH at the time of this writing is worth about 3000 USD). This is great for the NFT industry, and it makes both the buyer and the seller happy. Besides, you get own something that could have a significant resale value in the future. But, here’s what my hate…or skepticism comes from when it comes to NFTs. Ultimately, NFTs are inherently illiquid. You can sell 1ETH on an exchange in a few seconds, but you can’t do that with an NFT that you just bought. You will have to have a buyer for it who’s willing to pay the price you’re looking for.

Another problem is the current market supply. Hundreds of NFT projects are being released every single day, and people are picking up rare ones very quickly. If you look at the activity on Opeansea.io, you’d know that many of the new projects have hundreds of items that remain unsold, with the good one already being taken or listed for sale at price much higher than the average price for that project…or “the floor” as it is called! So, what happens to these unsold items? If they stay unsold in the market for too long, what happens to the hype behind the project?

Gary Vee mentioned something in one of his interviews a few days ago which I agree with. Basically, he believes that 95% of all NFTs right now are bad investments, and NFT creators’ real work should begin AFTER they list their artworks for sale at a marketplace. The project has to create a community and provide value. A gif or a jpeg file alone…on its own…without a community around it, will lose its value in the long term.

How do you stand out when there are thousands of other projects? How do you identify projects that the creators have built solely for the purpose of making money from the sale and existing out of it!? With all this massive sales news all over the internet, it is tempting to FOMO in, and spend some of your ETHs. But as with any investment, you must be able to separate your emotions from the hype, and really identify and evaluate the community around it.

Are the creators responsive? Do they have an active discord group? What “else” they are going through since they posted their NFTs for sale? Have they built other projects in the past? Were those projects successful? Remember you’d ask yourself similar questions if you were buying a stock or a house, or a used item with potential resale value? The difference being stocks and cryptos are liquid assets, mostly. NFTs are not!

I think this space will do very well in the next few years. Especially, with the gamification aspect of some projects. However, I also think that not all projects will do well. Do your due diligence before you make any investment in digital art!

You might be wondering if I own an NFT. Yes, I do. But it is money that I can afford to lose if the project does not go anywhere. I do see it as a risky investment, but it’s a managed risk. I’d not recommend doing something crazy with your existing assets to be able to buy NFTs that you “think” will do well…

I will share new NFT projects on this site. I will also share how I feel about the project. But this is an entertainment website, and I am not a financial advisor. Just because I own something does not mean that you must hop on the project. If I own it, it means that I simply like it. It does not mean, that I think I’ll sell it for a lot of ETHs in the future. Please please do your own research and make your own decision before buying NFTs!

Embrace new technology, educate yourself about this space….but think twice before you buy the first thing that you run into!

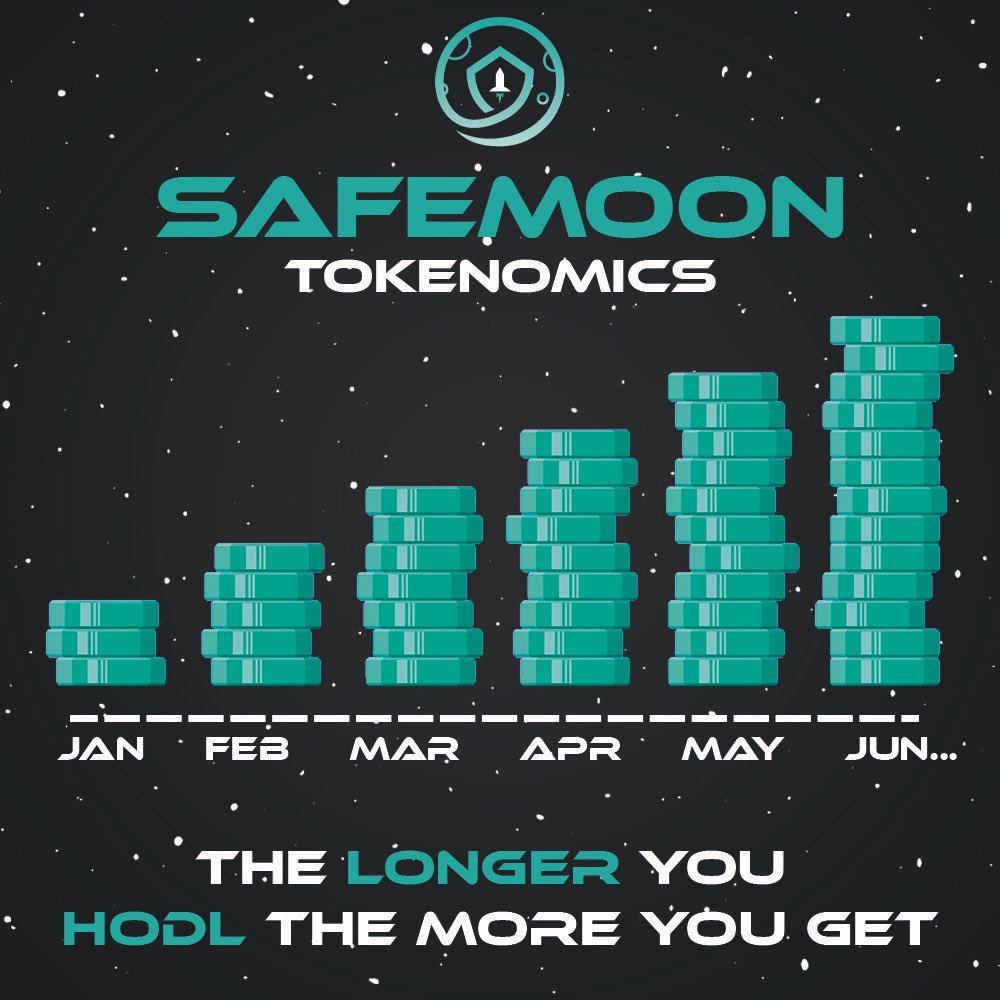

]]>However, most earlier adopters of this coin have used a different way to buy this coin. The process has some steps, and I’ll attempt to explain just that here in this article. Remember, this is not investment advice, and please do your due diligence before investing in cryptocurrencies. Personally, I have some investment in SafeMoon as with a few other cryptos, and I’d not have written the article if I did not have tried this purchase process myself.

First, you have to create an account with Binance.us or Bittrex.com if you do not have an account with either of them. I use both the exchanges and they are both very good. They both have KYC (know your customer) and they will verify your identity. I found the ID verification process at Bittrex to be a little quicker. Quicker as “Same day- quicker”. At least that’s what it was for me!

Feel free to use my referral links above to register on either of these platforms.

Now:

1) Install TrustWallet App on your smartphone

2) Buy BNB (Binance Coin) on Binance or Bittrex

3) Withdraw your BNB to your BNB wallet on TrustWallet (Please make sure you’re withdrawing to your BNB wallet)

To do this, click on BNB from your list on TrustWallet and click Receive (It will show you the address you need to withdraw BNB)

4) The process may take a few minutes for your BNB to appear on TrustWallet due to network congestion and trading volume

5) Once you have your BNB on TrustWallet, convert it to Binance Smart Chain (similar icon as BNB). To do it, click on BNB on TrustWallet > More > Swap to Binance Smart Chain

6) Now, it won’t let you swap 100% of your BNB all at once. Do it in 50% increments until you’ve swapped almost all of it…You will NOT be able to swap 100% and will have a few dollars left on BNB.

7) Now, click DApps at the bottom of your screen (on Android)

8) Find PancakeSwap from the list and then switch your BNB (Max) to Safemoon (choose Safemoon from the list) Please let your slippage to 11% for it to process!! Confirm the transaction!!

There you have it!! Now, you should see your SafeMoon balance on TrustWallet.

If you have an iPhone, you just have an extra step because you have to “activate” DApps on TrustWallet.

To do this, follow everything until #6 in the above process and then open Safari Browser and then type in the URL: trust://browser_enable then hit Go!

Go back on TrustWallet and you will now see DApps at top-right corner!

]]>This has been going on for months, and although most residents understand that it has not been an easy task for Illinois to implement some of the federal programs (PUA and PEUC), it seems as though that the people on top have not done much to prepare themselves for an impending benefit distribution disaster.

Many currently unemployed started receiving their payments back in March 2020 shortly after the pandemic began. As unemployment entitlement benefits last exactly a year, many of those currently unemployed would see their benefits stop exactly after their benefit year-end date. If you are unsure what your benefit year end-date is, log on to your IDES account and pull up any payment history. On top of the page, you will see your Claimant ID and your benefit year end date. That date is crucial because that is the last day for which most of you you will receive benefits.

However, technically, since President Biden signed the new relief bill last week, your benefit extensions should remain active until the first week of September 2021. This makes many people believe in case they are unable to secure a new employment anytime soon, they would keep receiving benefits without interruption, right? Wrong! This is exactly where the problem begins!

If you have not worked at all since last year when you started receiving unemployment, you will have to CALL and physcally speak to an agent before those new “extensions” can resume. Most unemployed Americans did not work at all since last March. Therefore, this warning goes to hundreds of thousands of people. This also means that you will have to put yourself on a callback list soon, and hope that someone calls you back only a few days after your benefit year ends. Remember, if you have not worked since last year, regardless of whether you have a balance in your unemployment account, you will NOT receive benefits unless you speak to someone. Only a live person can put you on a transitional claim (PUA/PEUC/EB). Unless you do that, you’d receive nothing. No $300 boost, no regular payment….zilch!

There will not be any automatic continuation of the extension. At this point when Americans are struggling to make ends meet, you’d think that our state government would be on top of their game, and that they would do everything they can to help Illinois residents. You’d expect they would make these extensions automatic as long as the claimants are certifying for benefits as “still unemployed”. You’d hope that someone in the government would know about this very well, and bring up this issue with Governor Pritzker and the IDES.

This may not apply to you IF you’ve worked part-time [and have made 3x your Weekly Benefit Amount) or were unemployed on and off since you first started receiving unemployment. But, the percentage of those people is low.

You might be asking what you can possibly do right now. First: check that benefit year end-date in your payment history. If you have not worked since you started receiving unemployment, you can be sure that your benefits would stop after that date. Second: Put yourself on a callback list right away if you are not on one already. Third: if you receive a call after your benefit year ends, request the agent to put you on a “transitional claim” based on whatever extensions are available for you (PUA or PEUC depending on the type of your initial claim). Keep certifying if you can even if your benefits stop.

Reminder: the agent can put you on an extension ONLY AFTER that benefit year-end date. Not a day before! There is no way for them to “push it through”.

You can also write to the Governor’s office and share this if you’d like. Nobody in this country should have to wait to receive unemployment benefits in the middle of a pandemic while their income has been slashed to almost nothing due to no fault of their own. People have endured enough since last year. They do not need any more financial stress.

Also, please share this with anyone you know who’s currently unemployed in Illinois so they are aware. I do not make money from you sharing this. There is no ad here. This post is not designed to the bash the IDES as I understand implementing some of these changes into a set algorithm is difficult. However, something could be done so this does not happen. I am just a citizen journalist trying to help my fellow Americans!

Be kind to each other!

]]>

Everyone has a different investment approach, goals, risk tolerance, time horizon, liquidity, constraints, etc. Because significant differences exist among investors, there are important factors to be considered when implementing an investment strategy such as the individual objectives and any other important factors along with a due diligence process.

There are numerous ways investors can diversify their account. One of the most known and widely used is the life cycle asset allocation. The asset allocation is considered the most important decision made by investors. A good reference is 100 minus age. It is believed that as investors get closer to retirement age, the more risk averse they become, hence the change in allocation is recommended from more equities to more fixed income as they progress in the life cycle.

Total risk can be measured by the standard deviation and this type of risk can be diversified. Systematic risk on the other hand cannot! Beta measures systematic risk which cannot be diversified away, the beta for the market is 1.0. So, if the portfolio constructed has a beta higher than 1, it means it will have more price volatility than the market. On the other hand, if the beta is lower than 1, less volatility can be expected.

]]>Since JK Rowling wrote her first Harry Potter book, she has sold hundreds of millions of them, and a fast-growing fanbase has formed around anything Harry Potter-related. In the last few years, book collectors around the world spent hundreds of thousands of dollars picking up some of the first-edition and early-print copies for the first published books, with one selling on auction for over $90,000. As you can imagine, a first edition copy in excellent condition is always a coveted buy because only a few hundred to a few thousands of copies are published. As there are more and more reprints, the first edition books become more and more valuable and hard to find.

In the last few years, I noticed the market for these books have become quite big with Harry Potter book-collector fans growing everywhere in the world. Therefore, as the books were also translated in dozens of languages, even some foreign language editions have become extremely rare and valuable, thereby making some first prints making extremely difficult to impossible to find.

However, you must do your due diligence and read up a lot of content around this if this collection game intrigues you. Many sellers online often scam unsuspecting buyers by advertising a book as “rare”, “first edition first print” etc. You must learn to detect and pick the right book. I’d recommend you visit AllThePrettyBooks where the editor posts frequently and also uploads videos on YouTube which you will help you understand this space a little better if you are new to this.

I do own some “rare” Harry Potter books myself. But, it took me a lot of time and effort to collect them. Rare foreign edition books are hard to find even in the country where the book was published. Sometimes, you’d be lucky to pick one up at a foreign-based website if something is up for sale, and figure out a way to get it shipped to your country. I see Harry Potter as a good investment long term as the “craze” around it keeps growing. Besides, as the collector community becomes more international, you will always find a good buyer.

If you’re interested in starting your early edition collection right away, Book-1 2nd edition translation in Yiddish is now available for pre-order as I type. The first edition already being sold out days after its release!

they can improve the return of the portfolio since they differ from the traditional stock and bond

investments and they are not bound to the same constraints of the more traditional investments.

A list of traditional alternative investments includes real estate, private equity, commodities,

hedge funds, managed futures, and distressed securities. 10% to 20% is appropriate to allocate to

alternative investments but it really depends on the risk you are willing to digest. Some common

features of alternative investments that investors should be aware of include illiquidity,

diversifying potential, higher costs due to more complex strategies and difficult performance

appraisal due to the complexity of valid benchmarks.

Since they do not behave the same way as the market, the most significant benefit is

diversification. These assets provide a low correlation to the stock market and can help investors

hedge against inflation. They provide a broader diversification which aids in mitigating

volatility within a portfolio. Given the broad range, however, it is very important for an investor

to dot their due diligence and know the market for the investment, benchmarks, and historical

data, strategy as well as any issue in performance reporting prior to adding them to their

investment portfolio.

Just as there are benefits, these non-traditional investments come with unique risks that should be

taken into consideration before allocating to a portfolio. The top risks to consider are higher

fees, more complex strategies, less transparency, and less liquidity. Some investors might find it

is worth to take on the additional risk as alternative investments can improve the return of an

investment portfolio, increase diversification and possible reduction in volatility when compared

to traditional investments.

Each investor has different needs or individual circumstances which can change due to several reasons. These include change in wealth, time horizon, liquidity needs, tax circumstance, change in legal consideration or unique individual needs which may arise and can lead to needed changes in a portfolio allocation. Not to mention, markets are always moving and unpredictable which can also lead to change in a portfolio’s allocation. Rebalancing ensures the portfolio remains as intended, making it essential to any investor.

“There is no perfect formula to construct the optimal portfolio”

Rather than scheduling an annual or quarterly rebalancing which can result in wasteful transaction costs. Consider a percentage threshold which is neither too broad nor too narrow. Try not to have the thresholds too wide that would cause lost opportunities.

Photo Credit: Markus Spiske

There is no perfect formula to construct the optimal portfolio. However, with the future being uncertain, an investor should aim to diversify their investment and not have it all in one asset class. This allows the investor to limit their risk.

Diversification and alternative investments can help hedge against unsystematic risk in a portfolio. The recommended percentage is to have between 10 to 20 percent of alternative investments in your portfolio.

Overall, rebalancing can be a complicated process but nonetheless, a necessary one. It is important to set thresholds that are not too broad or too narrow when rebalancing as it can cause unnecessary or excessive fees and it can expose the investment to extremes. Investors who do their research and ensure their portfolio is well diversified and aligned to their long-term goal are on the best track to consistent long-term growth and happiness!

]]>If there’s anything many college students share in common, it’s being broke from time to time. So why on earth should we bring up investment? As counterintuitive as it may sound, now is the perfect time to start investing. This post explores why you should become a student investor.

- The Power of Compound Interest

You’ve probably heard, learned, or read about it thousands of times. One of the major factors that affect compound interest is time. Let’s assume you’re able to save $20 every week and decide to invest it in a low-risk market index like S&P 500 with an average annual interest of 10%. That works out to be about $1,000 yearly. If you start college by age 17 and retire by age 67, you will make $1,161,600. All the money you have contributed towards retirement is $50,000. That’s over $1.1 million in profits.

Now, let’s assume you wait till you’re 22 before you start investing, all other factors being equal, you’ll make $790,0231. All the money you have contributed will be 45,000 and your profit will be about $750,000. Pretty impressive, right?

But look at the numbers carefully, just because you failed to invest $5,000 while in college, it accrued to over $370,000 in losses. You see why you have to take investing seriously now.

To secure your financial future, you have to become a student investor.

- You Have Lower Financial Responsibility

The majority of college students are typically unmarried. Heck, you might even be receiving financial support from your parents. Couple that with the fact that about 70% to 80% of college students work while attending school. So, it’s easy for you to squeeze out money for investing.

Moreover investing for beginners can be a risky endeavor, especially if you’re looking into obtaining higher rewards. By investing in riskier stocks, you can make buttloads of money, but you can also lose money.

When you have kids or mortgages to worry about some years down the line, taking those risks would not be wise. Now that you have more disposable income, use it to explore the world of investing.

- Paying For College Debts

College loans are one of the biggest problems that haunt down college graduates for years. While it’s prudent to pay off your college loans as soon as possible, it shouldn’t be done at the expense of investing. Why? Because the interest rates for federal student loans are way lower than that for many low-risk investments. This means that your debt accrues at a far lower rate when compared to the gains you can get from investing.

So, the best strategy is to do both. Profits from your investments can be used to cover part of your student debt in the future.

To secure your financial future, you have to become a student investor. As you’ve seen, your decision to postpone investing will impact you negatively in the long run. Now is the right time to learn about investing for beginners. Sharpen your investment knowledge and skill as you navigate the complex world in investing. Remember, your financial future rests in your hands.

]]>